Bloomberg reported this morning that Adobe was getting close to buying Figma, a former startup and private-market unicorn in the design space, for around $20 billion. The Photoshop-maker then confirmed the deal with a release and a short investor presentation. TechCrunch’s coverage of the announcement is here.

Shares of Adobe were off more than 15% following the news.

The transaction is massive in dollar terms, making it worth our while to unpack. Below we’ve collected information on the size of Figma in revenue terms, considered its cash flow position and chatted through what the transaction could mean for other companies of similar size that are waiting out the current IPO drought.

Before we do all that real work, however, can I just say that I am oddly bummed by the deal?

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

Figma is somewhat of a classic startup and venture capital success story. Following a seed round back in 2013, Figma attracted regular external investments through a mid-2021 Series E worth $200 million that valued the software upstart at around $10 billion, per Crunchbase data. At one point, selling for a mere double of a final venture round would be a smaller exit price than what investors would have hoped when they executed the investment. But! A doubling of a 2021-era valuation in 2022 is a massive win, given how far the valuation bands for technology companies have shifted in the last year.

And yet, it’s a bummer. Why? Because what makes startups more than just interesting business case studies is their shot at becoming incumbent killers. The goal of startups is to wield that what’s next cudgel and beat the winners of yesteryear over the head with it until they scream. Figma staying indie and not selling to Adobe in the future, but buying Adobe in the future, has now been precluded. I am let down by that.

And yet, it’s a bummer. Why? Because what makes startups more than just interesting business case studies is their shot at becoming incumbent killers. The goal of startups is to wield that what’s next cudgel and beat the winners of yesteryear over the head with it until they scream. Figma staying indie and not selling to Adobe in the future, but buying Adobe in the future, has now been precluded. I am let down by that.

Now that I have that out of my system, let’s dig into the numbers of the deal. It’s a corker.

What’s Adobe getting for $20 billion?

Adobe has one of the more annoying fiscal calendars out there, with its business year ending on November 30 each time we circle the sun. In practice, this means that Adobe’s Q3 of its fiscal 2022 closed at the start of September. Thankfully, the company’s fiscal quarters and the calendar the rest of us use are merely offset by a month, so we can stick to 2022 when we discuss its results.

In the third quarter of its fiscal 2022, Adobe reported revenues of $4.43 billion, up 13% year over year, GAAP net income of $1.14 billion and operating cash flow of $1.70 billion. Those results helped Adobe earn a market cap of $173.9 billion before the deal was announced, per YCharts data.

The company’s wager on Figma, then, is worth more than 10% of its pre-transaction worth. By some margin. Because the deal is worth a double-digit percentage of the acquiring entity, it is by our definition a non-trivial transaction, therefore one we can vet both strategically and financially.

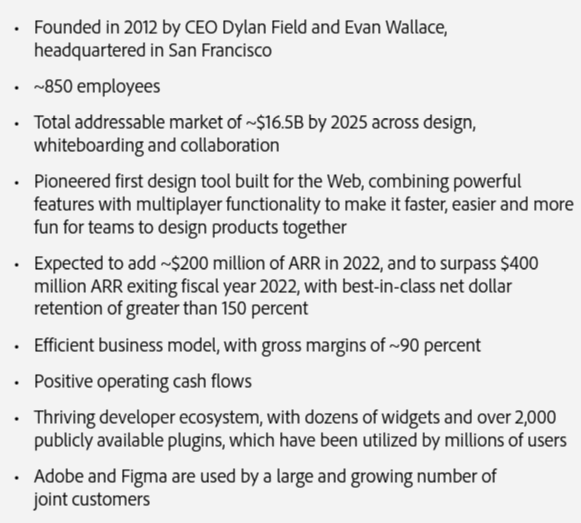

Happily, Adobe provided us with the information that we need to consider the transaction from both perspectives. Here’s the key portion of its investor presentation:

Figma is selling for more than its TAM, which is notable and surprised us a little bit. Perhaps that is more standard than we are aware of, but the fact makes the deal seem rather dear from the get-go.

How expensive is the transaction? We know its cost in relation to Adobe’s market cap, but let’s parse the above financial data into simpler terms to get a better grip on things:

- Figma is expected to expand its annual recurring revenue (ARR) by around $200 million this year.

- That growth will put it on an ARR pace of more than $400 million by the end of Adobe’s fiscal year 2022.

- Figma is therefore growing at around 100% per year while at a nine-figure scale; that pace of growth at its size is insanely good, making Figma one of the best-performing former startups in growth terms we’ve seen in recent years.

- Part of that growth is fueled by new customer adds, but a material portion comes from customers buying more from the company over time — net retention of 125% is good; “greater than 150%” is bonkers.

- Because so much of Figma’s growth comes from net retention, it appears to have a below-average need to spend on sales and marketing, helping it achieve positive operating cash flows, per Adobe’s note.

Summarizing: Figma is a whip-ass software company and it is charging Adobe a big price.

A $400 million ARR figure for the end of 2022 — be it calendar or Adobe fiscal — values the transaction at around 50x revenues. That’s not cheap by today’s standards, but it stands to be more reasonable as time goes on. In two years’ time, for example, if Figma can keep its ARR growth flat in dollar terms — decelerating in percentage terms, but whatever — its ARR multiple at the transaction price comes down to 25x, which, while still not cheap, makes a lot more sense.

If Figma can expand its yearly ARR growth in dollar terms, it gets less expensive even faster than that.

Why would Adobe be willing to pay above-market multiples for Figma today? Because the price tag for Figma would only rise as it grew. And Adobe is not merely buying another company — it’s buying a growth engine and deleting a potentially material competitor at the same time.

Recall that Adobe grew by just 13% year over year in its most recent quarter. Figma’s far-faster growth will provide some juice to Adobe’s overall growth rate for years to come, while also not disrupting cash generation used for things like share buybacks (Adobe “repurchased approximately 5.1 million shares” in its most recent quarter, it reported).

So, the deal is a growth stimulant without a drag on operating cash flow. Is that enough to justify the price tag? Maybe, maybe not. But scroll back up and read the final bullet point from our investor deck excerpt. It reads:

- Adobe and Figma are used by a large and growing number of joint customers.

That matters. Adobe must have seen rising usage of Figma among its existing customer base and worried that as the smaller company expanded its product remit, it could eat into Adobe’s revenues. So the deal is a growth booster, yes, but also a revenue defender of sorts for the larger company; Adobe is buying not only relevance with a host of designers outside of its current customer roster but also limited defections, perhaps, to a growing competitor with obvious product-market fit.

It’s not bad to be an incumbent. I just want to see more of them knocked off their pedestals instead of using their prominence as a way to ensure that no one else can reach their stature.

Finally, the Figma-Adobe deal is notable because, in a more normal market, the design unicorn would have been able to go public. However, with IPOs still utterly paralyzed, selling to a major is the only way for unicorns to provide whole-cloth liquidity to backers and other shareholders, like employees. This means that, until the IPO market regains its footing, the Figma deal could be a canary for similar transactions.

If so, we’ll be incensed; we have been cheated out of an S-1 filing from Figma, and that’s not something we’ll forget. Seeing it become a line item in Adobe’s future earnings reports instead of its own living, breathing public company deprives us of valuable information. Now we’ll never learn as much as we hoped.

Let’s pray that IPOs come back before other interesting companies follow in Figma’s footsteps.

Comment