Indian food delivery startup Swiggy is cutting about 400 jobs, or nearly 7% of its workforce, as the startup seeks to bring further improvements to its finances ahead of a planned IPO later this year.

This is the second round of layoffs at the Bengaluru-headquartered startup, which cut just as many jobs early last year.

The move comes as Swiggy attempts to further improve its finances. Though its food delivery business has been profitable for several quarters, the startup is not profitable at a group level. Zomato, Swiggy’s chief rival, became profitable last year.

Investment bankers and mutual fund investors hold the view that Swiggy, valued at $10.7 billion in its most recent funding round, will be very closely compared to Zomato by retail investors at the time of listing and needs to beat the older rival on many metrics if it desires a good valuation.

Swiggy didn’t respond to a request for comment. Indian newspaper ET first reported the layoff.

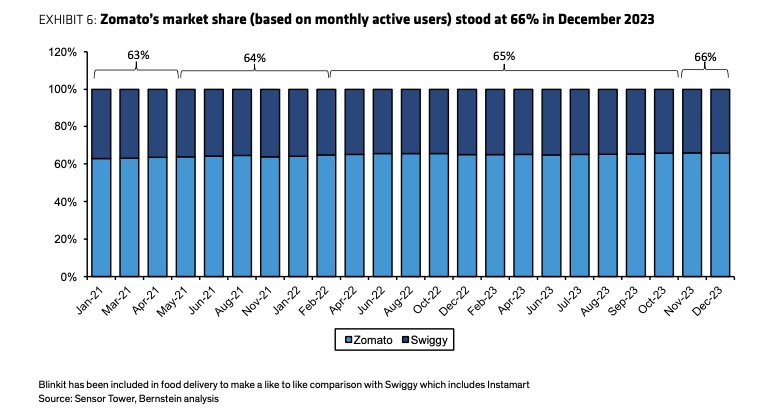

Zomato and Swiggy lead the Indian food delivery market, but in recent quarters Zomato has expanded its market share lead, according to UBS and AllianceBernstein. Zomato held over 60% of the Indian food delivery market, based on app user count, AllianceBernstein said in a note Wednesday.

“Post covid, Zomato has grown faster than Swiggy — both from a user base & GMV perspective driven by strong execution, wider penetration (Zomato is present in 750+ cities as compared to ~600 cities for Swiggy) and stronger content funnel,” AllianceBernstein analysts wrote.

“In the past three months, Zomato has incrementally gained ~100bps in market share in terms of monthly active users (MAUs). From a GMV perspective, Zomato holds ~54% share in food delivery as compared to Swiggy at 46% as of 1HCY23, Zomato’s food delivery GMV stood at $1.7Bn as compared to Swiggy’s $1.4Bn. Zomato has been a gainer in Tier 2+ cities as well as some Tier 1 cities — which has led to a higher MAU base for Zomato. Zomato had 58Mn annual transacting users in CY22, with food delivery segment exhibiting18.4Mn MTUs in Q2FY24.”

Comment